HUAWEI commissioned CEM industry research on Customer Experience (CX) in Digital era

Background

Five years have elapsed since Forrester1 first highlighted Customer Experience (CX) as a key strategy for Communications Service Providers (CSP) to move them off what it called “the endangered species list”. The arrival of the Smartphone marked the end of the CSP-controlled walled-garden business model and the emergence of disruptive OTT providers offering free voice and messaging services. CSPs were effectively on notice to either urgently re-invent themselves or face extinction2. New ways were needed to compete. Service differentiation through improved CX was identified from the outset as a strategy for CSPs to retain margins and stay relevant.

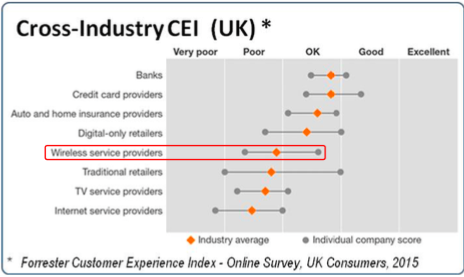

Cross Industry CX Measurements

We have long been aware that CSP brands, and cellular services in particular, fare poorly in cross- industry CX brand-loyalty surveys.Meanwhile, brands in the Airline and Retail industries demonstrate year-upon-year CX improvement with some moving from poor beginnings to being highly regarded brands. In contrast, CSPs have not improved their ratings significantly. Yet, some MVNOs succeed where traditional CSPs struggle. One UK MVNO, Tesco, scored higher than established mobile phone brands in a recent NPS survey3.

Figure 1, UK Cross-Industry Brand CX Comparisons 2015

Study Objectives

In, what Forrester refers to as the Age of the Customer (AoC), CX has become the new metaphor for brand quality. A new study was sought as a checkpoint on how CX strategies were being implemented. The research was designed to test a number of detailed hypotheses or suppositions, to find evidence of successful CX and business transformation projects in progress. The objectives were to understand CSP change-dynamics, identify roadblocks to progress and propose strategies to overcome blocking issues to accelerate progress. The following statements were tested 4:

1. Telcos do not have a cross-organization CX strategy.

2. Telcos collect customer data but fail to monetize it.

3. Telcos are slow to transform into digital organizations.

4. Telcos make poor use of omni-channel data to improve CX.

Study Findings

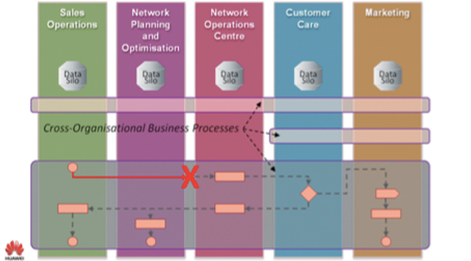

Telcos do not have a cross-organization CX strategy

We wanted to test the view that lack of cooperation between internal CSP organisations presents an ongoing barrier to transforming CSPs from being “inside-out” operations governed by network KPIs today, to becoming “outside-in” operations governed by subjective CX metrics. All respondents confirmed that the experiences they want to deliver had already been defined but 75% believed that they did not have the skills to execute the cross-organisational actions necessary to effect change.

We also asked which CSP organizations owned CX transformation budgets and found these to be fragmented across organisations, mostly split between COO and CMO but spent on internal projects rather than cross-organization CX initiatives. Only one CMO had 100% control over the CX budget.

All agreed that CX was important and had no difficulty defining a CX vision some even stating confidently that CX is now under control. This confidence was not matched by evidence of cross-organisational CX activities. With such disconnected processes, the “inside-out” status-quo persists. A view also exists that business transformation can be executed entirely from within, when working with third parties m bring fresh perspectives and be a more effective driver for change.

Figure 2, Disconnected Business Processes

Telcos collect customer data but fail to monetize it

Next we tested the belief that terabytes of customer data, captured routinely by CSPs, is of value to their business. We wanted to estimate the prevalence of internal and external monetization, i.e. where CSPs respectively (a) use customer data internally and/or (b) sell it to third-parties for a fee. Respondents struggled to articulate how customer data might be monetized and none was able to point to an instance where data collected by one organisational silo might be of interest to another.

Interviewees were asked how certain data monetization statements might apply to them over the next 2 to 3 years. The highest priority was assigned to increasing CX and service differentiation followed by supplementing adjacent services and personalization for marketing purposes. Other selections suggest that CSPs are busy retaining the customers they have and differentiating themselves through service offerings. External monetization of customer data is a rarity.

Ongoing CSP digital transformation projects do not include digital CX objectives

All CSPs want to reduce OPEX through digital transformation. Yet, when asked to select statements about transformation outcomes, we find that operational efficiencies and financial governance are rated highest

while statements about improvements in CX were rated least of all. 5

Many CSPs find themselves in a competitive pricing and value trap where the only certainty is a repetitive cycle of reduced margins; a race-to-the-bottom with no winners. Digital transformation allows large chunks of OPEX to be removed from the business, increasing margins and providing a breathing space to change. CSPs leading this charge report reduced pricing pressure and higher margins as CX gains are reflected in business KPIs.The plight of CSPs may actually be more desperate than they realise.6 Over The Top (OTT) providers like Facebook and others have their own relationship with customers, yet most CSPs appear to be a long way psychologically from offering value-propositions such as “we offer the best QoS for FaceTime and Whatsapp services” along with service offers with a millennial 7 marketing appeal. With Google and Facebook building their own international cable networks, the ante will surely be raised.

Figure 3, Response Summary of CX Objectives

CSPs with omni-channel care strategies but do not use data insights to improve CX

Finally, we tested the prevalence of CSPs adopting omni-channel customer care strategies. As support channels grow beyond voice to include webchat, social media and even smartphone apps, the risk of CX damage grows. Omni-channel implies that all brand-interactions are remembered from the first high-street store conversation to raising a request to for a free smartphone upgrade.

We found that Marketing Departments were most likely to own Omni-channel strategies yet in no case was a single group empowered with implementing it across the CSP. The value of the Customer Life-cycle Journey (CLJ) and where their customers were located on it was not understood. No cross organizational business process links were evident to help improve Omni-channel CX. It seems that CSPs are not really that committed to deploying Omni-channel with a view to improve CX.

Conclusions

Each hypothesis was strongly confirmed. The poor track record of CSPs in CX improvement projects may be down to a policy of benchmarking against other CSPs instead of against leading non- Telco brands. There are many cultural, process, and technology gaps in Telcos’ CX implementations.

Business as usual is no longer an option if CSPs wish to remain relevant and resist getting drawn into race-to-the-bottom pricing-battles. The strength of organizational silos and their resistance to change remains a barrier to CSP progress in the CX domain. The importance of CSPs linking digital transformation to improved CX, increased margins and staying relevant is not fully appreciated.

CSPs generally don’t measure OTT consumption with a view to developing new value propositions and CxOs don’t appear to grasp the OPEX benefits of SDN/NFV and break down organizational silos while rolling out digital business transformation and enterprise “big-data” strategies in tandem.

The good news is that all is not lost. Some CSPs have successfully managed to transform themselves and increase their value in the eyes of their customers and attain CX and CSAT levels that exceed initial expectations. As one CEO proclaimed when transforming the fortunes of his CSP operation:

“If you make the customer the final arbiter in everything you do, firstly, you become more responsible to the market; secondly, it stops you being worried about internal factionalism and it rallies people to something that is bigger than any individual.” 8

Successful CX and Digital Transformation projects require CSPs to act maturely to bring together all of its resources and energies in a holistic way, i.e. a vision for the future, all of its organizations, people, partners, processes, metrics and measurement tools. CX has to be in the spirit of everything the Enterprise does.

1The Future Of Telecom: Strategies To Move Off The Endangered Species List – A Business Transformation Futures Report by Dan Bieler,

2 https://www.forrester.com/The+Future+Of+Telecom+Strategies+To+Move+Off+The+Endangered+Species+List/fulltext/-/E-RES60888

3 UK Net Promoter Score CSP Survey, Satmetrix, 2015

4 Qualitative interviews limited to eight (8) respondents in CSPs, in Marketing or CX roles at CxO or Senior Management levels. Of these, two (2) were Mobile-only CSPs, one (1) a Cable Operator, one (1) a Fixed Line Operator and four (4) Multi-Play CSPs offering Mobile, Broadband and ipTV services.

5 Figure 3 taken from commissioned study conducted by Forrester Consulting on behalf of Huawei, December 2015

6 See Forrester report: “The Future Of Telecom: Strategies To Move Off The Endangered Species List”

7 Millenials: The market segment of customers born since the year 2000.

8 David Thodey, Telstra CEO, 2009 – 2015. See also : http://blogs.forrester.com/dan_bieler/15-11-16- telstra_shows_promise_for_european_cios_as_a_network_solutions_provider_in_asia